Why Should I File ISF For Rubber Bale Cutters

?Are you importing rubber bale cutters and unsure whether you must file an Importer Security Filing (ISF) before the ocean vessel leaves the foreign port?

Why Should I File ISF For Rubber Bale Cutters

Filing an ISF is one of those paperwork steps that can make or break your shipment timeline and compliance record. When you bring in specialized tools like rubber bale cutters, the U.S. Customs and Border Protection (CBP) needs advance visibility into what’s coming, who’s responsible, and where the cargo will land in the U.S. Filing ISF helps you avoid penalties, reduces the likelihood of a hold, and keeps your import process predictable.

What ISF actually is and why it matters

ISF (sometimes called “10+2”) is an advance cargo-data rule that requires importers or their agents to provide certain data elements to CBP before a vessel departs a foreign port. For you, this means that CBP can assess potential security risks and clear goods more quickly when they arrive. It’s not just bureaucracy — it’s a required step and the timing and accuracy matter.

Who must file ISF for rubber bale cutters?

You, acting as the importer of record, typically carry the legal responsibility for filing ISF. You can delegate filing to a licensed customs broker or a freight forwarder, but the ultimate responsibility for accuracy rests with you. If you’re buying on terms where the seller is the importer of record (e.g., DDP terms), confirm who will file because that party will hold the responsibility.

Common parties that file ISF

- You (the importer of record)

- Your customs broker (on your authority)

- A freight forwarder or NVOCC if permitted by contract

Make sure whoever files knows the product, the manufacturer, and the commercial terms so the data is correct.

What data elements do you need to submit?

You’ll need to gather specific pieces of information before filing. These are the core items CBP expects:

- Seller/Owner name and address (manufacturer or supplier)

- Buyer (if different from consignee)

- Importer of record name and address

- Consignee name and address

- Manufacturer name and address (or supplier)

- Country of origin

- HTS (Harmonized Tariff Schedule) number(s) or at least a clear product description

- Container stuffing location (where the goods were loaded into the container)

- Consolidator (if relevant)

- Bill of lading number and booking number

- Container number(s) and seal numbers

You should gather this information as early as possible — ideally when you confirm the booking.

When must ISF be filed?

ISF must be filed at least 24 hours before the cargo is loaded onto the vessel at the foreign port. For you, that means coordinating with the seller, freight forwarder, or shipper so the filing happens on time. Missing this window can result in penalties and cargo delays.

If things change after filing

If any critical information changes (like container number, consignee, or HTS), you can and should amend the ISF. There are procedures for ISF amendments, but late amendments won’t avoid penalties if original filing timing or accuracy requirements weren’t met.

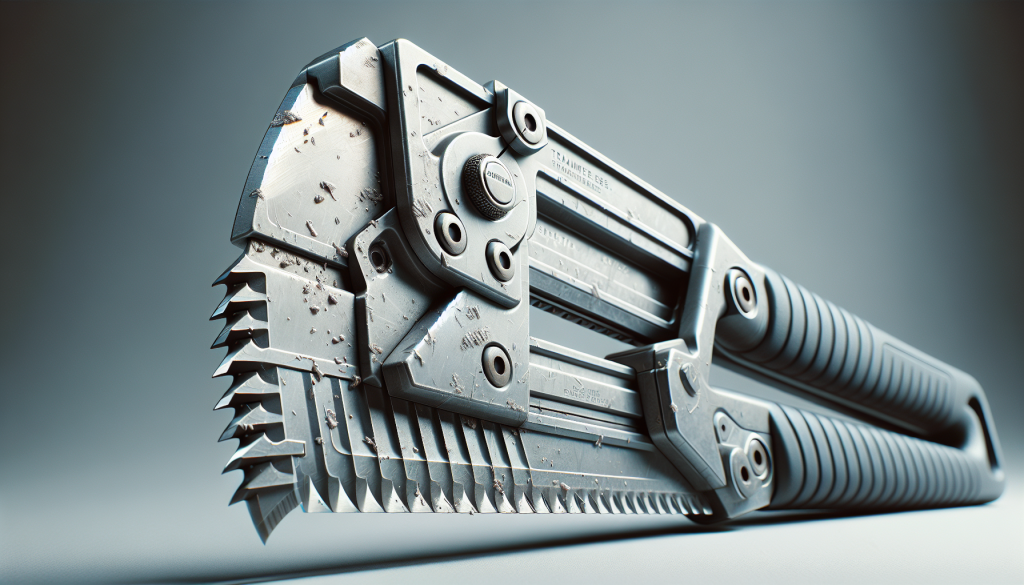

Why rubber bale cutters specifically triggers ISF attention

Rubber bale cutters are often specialized industrial tools. That can mean higher value, specific safety considerations, and sometimes ambiguous HTS classification. Because CBP uses ISF data to risk-score shipments, incomplete or vague descriptions (e.g., “tools”) may cause additional inspection or delays. Provide a clear description and correct commodity classification to reduce the chance of a hold.

Practical details to include for rubber bale cutters

- Precise product description: materials, intended use (cutting rubber bales), and model numbers

- Manufacturer details and production site (country of origin)

- Packaging and weight per container

- Any certifications or safety documentation if relevant (e.g., CE markings, testing data)

Step-by-step filing process for your shipment

Follow these steps so ISF doesn’t become a roadblock:

- Confirm the importer of record and who will file ISF.

- Collect required data elements from your supplier and forwarder.

- Assign accurate HTS descriptions — consult your customs broker if unsure.

- Prepare documentation: commercial invoice, packing list, booking confirmation, and manufacturer info.

- File ISF at least 24 hours before vessel departure.

- Monitor the filing status and vessel manifest.

- If the shipment diverts, is transshipped, or has container changes, file ISF amendments promptly.

- Coordinate with your customs broker and trucking provider for arrival pickup once CBP releases cargo.

This process covers start-to-finish actions you’ll take before and after arrival.

Edge cases you should know about

There are several non-standard situations that commonly affect ISF for items like rubber bale cutters:

- Transshipment: If your goods are transshipped through an intermediate port, you may need to account for two vessel movements. Confirm which leg requires ISF filing.

- LCL (Less-Than-Container Load): Consolidated shipments mean a consolidator might file certain elements. You still must ensure your specific product data is correct.

- Multiple manufacturers or suppliers in one container: You must provide manufacturer details for each product line.

- Missing manufacturer information: If you can’t get the manufacturer address, file with best available info and document your attempts to obtain full details — CBP can ask for proof of diligence.

- Re-consignments or splits post-departure: Amendments will likely be required and CBP may scrutinize changes.

Anticipating these helps you avoid surprises.

Penalties and consequences of not filing correctly

Noncompliance can get expensive and operationally disruptive. Potential consequences include:

- Monetary penalties per violation (CBP fines)

- Cargo holds or examinations that delay release

- Increased scrutiny on future shipments

- Potential seizure if CBP suspects criminal activity

- Additional charges from carriers and terminals for holds or storage

Filing on time and accurately reduces these risks significantly.

Bond and financial protection considerations

For ISF compliance you may need a bond to ensure CBP can collect penalties if necessary. Bond types you should know:

- ISF Bond (often covered under a single transaction entry bond or a continuous import bond)

- Single transaction bond: used per shipment

- Continuous bond: covers multiple entries over a period and is common for regular importers

Ask your broker about the right bond for your import frequency. Using a broker often simplifies bond handling and can reduce your administrative burden.

How to choose a customs broker or provider

Selecting the right partner makes ISF painless. Look for:

- Proven experience with your commodity (industrial tools, machinery)

- Clear service levels and ISF filing timelines

- Transparent pricing for filing, amendments, and bonds

- Coordination capabilities with trucking and warehousing

- Good communication and technology (online filing status)

One reason importers prefer brokers is that they handle ISF filing, amendments, and follow-up with CBP, freeing you to focus on your product.

Compliance tips and best practices

Make compliance routine so you avoid last-minute problems:

- Start ISF data collection when you confirm the order.

- Keep a checklist of the 10+ items required and update it per shipment.

- Maintain consistent HTS classification records and reasoning.

- Log attempts to collect missing manufacturer or supplier information.

- Use a broker if you want an added layer of review.

- Run internal audits of your ISF filings periodically.

- Train staff who interact with overseas suppliers so they understand what CBP needs.

Consistency and documentation are your best defenses against penalties.

The post-arrival journey: clearance to delivery

After the vessel arrives, CBP will use the ISF and manifest to manage risk and decide on release. If your ISF is accurate and timely, the clearance process is typically faster.

Typical steps after arrival

- CBP cross-checks ISF against manifest

- If no red flags, CBP releases container(s)

- Carrier updates status to “Available for Pickup” or “Intermodal Release”

- You or your trucker picks up the cargo and completes delivery

If CBP holds the shipment, you’ll coordinate with your broker to submit documentation or arrange inspection.

Why investing time in ISF filing saves money and time

Filing ISF is a small step that prevents big headaches. Timely and accurate filings reduce hold times, lower the chance of fines, and help maintain a smooth supply chain. For specialized goods like rubber bale cutters, detailed descriptions and correct manufacturer details are especially important because CBP may target tools and industrial equipment for closer inspection.

Final checklist before the vessel sails

Use this short checklist so nothing is overlooked:

- Confirm who files (you or broker)

- Get manufacturer details and country of origin

- Verify HTS classification or product description

- Collect container and booking numbers

- Schedule ISF filing at least 24 hours prior

- Arrange necessary bond coverage

- Prepare for amendments if any changes occur

Following this checklist will help you avoid the common pitfalls importers face.

Closing thought

Filing ISF for rubber bale cutters isn’t optional — it’s a compliance step that protects your shipment and your business reputation. By collecting the right data early, working with a knowledgeable broker, and following a clear process, you’ll minimize risk, reduce delays, and make customs clearance a predictable part of your import workflow. If you want help with regional considerations, local carriers, or obtaining the right bond, consider contacting a specialist offering ISF Solution in California who can tailor assistance to your needs.

?Are you buying rubber bale cutters from overseas and wondering what the ISF process looks like, start-to-finish?

Why Should I File ISF For Rubber Bale Cutters

You need ISF because it’s how CBP gets advance notice of inbound ocean cargo. Rubber bale cutters, especially when shipped in bulk, can attract additional scrutiny unless you provide clear, accurate pre-arrival data. Filing ISF well in advance reduces surprises when your cargo arrives.

What ISF requires from you

ISF requires data that gives CBP a clear picture of what’s on the vessel, who made it, who’s importing it, and where it’s headed. For specialized items, more precise product descriptions and manufacturer data will cut inspection risk.

Preparation: what to gather before filing

Before you or your broker files ISF, make sure you have:

- Seller and manufacturer names and full addresses

- Importer of record name and EIN

- Consignee details

- Product description for rubber bale cutters, including model numbers

- HTS classification or a reasoned description

- Container stuffing location and booking number

- Container and seal numbers (if available)

Gathering this early prevents last-minute scrambling.

Why exact product descriptions matter for your cutters

Generic descriptions invite examination. If you describe the items as “industrial cutting tools” and they’re actually specialty rubber bale cutters, a red flag can trigger inspection. Be specific: include the use, part numbers, and composition.

Filing timeline and who files

ISF must be lodged at least 24 hours prior to vessel departure. You, as importer of record, are legally responsible but can authorize a licensed customs broker or freight forwarder to file on your behalf. Choose a reliable filer because mistakes cost money and time.

The ISF filing steps in practical terms

Here’s a simple step-by-step outline you can follow:

- Confirm importer-of-record details and who will file.

- Collect supplier and manufacturer information.

- Choose or verify HTS classification with your broker.

- Prepare supporting documents: invoice, packing list, booking confirmation.

- File ISF at least 24 hours before loading.

- Monitor vessel status and ISF acceptance.

- Amend promptly if any critical info changes.

Following this sequence reduces compliance risk.

Handling LCL and consolidated shipments

If your cutters ship as LCL in a consolidated container, the consolidator often files some elements, but you still must ensure your specific manufacturer and product details are correct in the ISF record. Coordination with the consolidator is essential.

What to do when multiple suppliers share a container

Provide manufacturer info for each product in the container. If data is incomplete for one supplier, document your attempts and supply best available info; you might need to amend later.

Bonding and financial requirements

CBP expects a bond if there’s risk of potential penalties. Many importers use a continuous customs bond to cover routine imports. If you work with a broker, they’ll advise the right bond structure and often handle procurement for you.

Common errors that trigger CBP action

Avoid these frequent mistakes:

- Vague product descriptions

- Incorrect or missing manufacturer address

- Wrong HTS classification

- Late filing (after the 24-hour deadline)

- Failure to amend when critical data changes

Correct these proactively to keep your shipments moving.

What happens at U.S. arrival

After arrival CBP checks ISF against the vessel manifest. If everything matches and the shipment doesn’t trigger high risk, CBP releases the cargo for inland movement. If there are irregularities, expect a hold, inspection, and potential delay.

Mitigating delays and improving speed

- File early and accurately

- Use a customs broker familiar with your product class

- Keep complete commercial documentation organized

- Ensure your carrier and forwarder communicate booking and container number changes immediately

This operational discipline helps you maintain predictability in your supply chain.

Edge-cases to plan for

- Transshipment: confirm whether the first or final leg requires ISF submission and what data is needed for each.

- Manufacturer unknown: keep records proving you tried to obtain information and file the best available info.

- Split shipments: ensure each shipment’s ISF reflects the correct container and manufacturer associations.

Pre-planning for these makes your customs process smoother.

Best practices summary for your rubber bale cutters

- Treat ISF as part of your procurement timeline, not an afterthought.

- Maintain standard data templates for suppliers to fill in.

- Audit your ISF submissions periodically for accuracy.

- Work with a broker when in doubt — brokers can help with classification and bond advice.

Filing ISF correctly protects your timeline and reputation and prevents unnecessary extra costs. If you need a partner specializing in import logistics and government filings, consider reaching out to providers who advertise ISF Solution as a core offering.

?Are your rubber bale cutters on a sea shipment and you’re thinking about how ISF filing ties into clearance, bonds, and trucking?

Why Should I File ISF For Rubber Bale Cutters

Filing the ISF is essential to keep the import process moving smoothly. It’s not just about obeying rules — ISF filing links security checks to downstream clearance, helps avoid holds, and aligns customs release with your trucking plans so delivery isn’t delayed.

How ISF integrates with the rest of your logistics

ISF is one piece of a coordinated sequence that spans from supplier booking to final delivery. If you think of the import chain as a relay race, ISF is the baton handoff between foreign loading and U.S. customs clearance. Doing it right keeps the baton moving.

How ISF affects clearance and bond decisions

Correct ISF filing reduces the likelihood of CBP holds, which in turn avoids the need for emergency bonds or costly re-work. If CBP flags a shipment, having a proper bond in place can be the difference between quick release and prolonged detention.

Types of bonds relevant to you

- Continuous import bond covering multiple entries

- Single entry bond for one shipment

- ISF-specific coverage often bundled into broker services

Talk with your customs broker to choose the correct option for your shipment frequency and risk profile.

Coordinating ISF with trucking and pick-up

Once CBP releases your containers, you’ll need a trucker to pick up and deliver. If ISF was late or incorrect, release could be delayed and truck appointments missed — resulting in additional fees. Coordinate ISF acceptance status with your trucking provider to book pick-up windows confidently.

A practical coordination checklist

- Confirm ISF acceptance before scheduling trucking

- Provide carrier with delivery order and release confirmation

- Ensure terminal access documentation is ready for the trucker

- Keep trucking company updated on potential hold status

This level of coordination reduces terminal detention and demurrage costs.

The filing and clearing sequence explained

- Supplier books cargo and provides required ISF elements.

- ISF filed 24+ hours before vessel departure.

- Vessel manifests and ISF data are used by CBP for risk assessment.

- On arrival, CBP either clears or holds containers for inspection.

- Upon release, the ocean carrier updates the status to allow trucking pickup.

- Trucking company completes inland move and delivery.

Knowing each step helps you plan resources and cash flow.

Special compliance tips for rubber bale cutters

- Document the technical use and specifications of the cutters so customs can see they are legitimate industrial tools.

- Maintain provenance records if materials are sourced across borders.

- If the products require specific permits or certifications, have those documents ready for inspection.

These extra measures avoid confusion and hold times.

Dealing with amendments and last-minute changes

If container numbers, seals, or consignee names change after filing, you must submit an ISF amendment. Late amendments can still be made, but frequent or late changes increase scrutiny. Keep your supplier and forwarder aligned so you minimize post-filing edits.

Common scenarios that cause delays — and solutions

- Carrier changes vessel or route: confirm whether a new ISF leg is necessary and amend if needed.

- Consolidated container mixing: ensure accurate manufacturer mapping in ISF.

- Missing HTS: ask your broker for provisional classification and update when finalized.

Proactive communication reduces the chance of surprise inspections.

How a broker can streamline everything

A broker can handle filing, bond procurement, amendments, and coordinate with trucking providers. Many offer bundled services so ISF filing ties directly into customs entry filing and inland transportation scheduling. If you prefer a single point of contact, find a broker that provides an integrated package described as ISF Filing, Clearance, Bond, and Trucking Coordination to simplify the whole operation.

Final compliance checklist before product arrival

- Confirm ISF accepted by CBP

- Confirm bond coverage is active

- Verify customs entry or release instructions are in place

- Book trucking appointment after checking release status

- Prepare invoice, packing list, and any certificates for inspection

This checklist minimizes delays and keeps costs down.

Closing note

Coordinating ISF filing with clearance, bonds, and trucking is key to ensuring your rubber bale cutters reach your warehouse when expected. Thoughtful pre-shipment planning and a single coordinated workflow prevent costly bottlenecks.

?Do you need to understand the ISF responsibilities for importing rubber bale cutters and how a customs broker supports compliance?

Why Should I File ISF For Rubber Bale Cutters

ISF protects U.S. ports and ensures CBP can target high-risk shipments before arrival. For your rubber bale cutters, filing ISF with precise data reduces inspection risks and smooths customs entry. A professional broker can help ensure filings match other customs paperwork to avoid inconsistencies.

The role of a customs broker in your ISF process

A competent customs broker helps with HTS classification, bonds, entry filing, and communicating with CBP on your behalf. They’re especially valuable when your product descriptions are technical or when shipments are frequent.

Data, timing, and who files

ISF must list key data elements and be submitted 24 hours before loading. You can file directly or authorize a broker. If you use a broker, make sure they’re licensed and have documented agreements outlining responsibilities.

Typical data elements (what you’ll provide your broker)

- Seller/manufacturer details

- Consignee and importer details

- Product description and HTS

- Booking, bill of lading, and container numbers

- Country of origin and container stuffing location

Providing complete data upfront reduces the need for later amendments.

Customs entry and post-arrival processes

ISF is separate from customs entry, but they must align. Once the ISF is accepted and vessel arrives, the customs entry processes duties and taxes. If ISF and entry data mismatch, CBP may hold cargo. That’s why your broker should coordinate both filings.

Choosing the right broker services

Look for a broker that provides full-service import compliance: U.S. customs bond procurement, ISF filing, customs entry filing, and audit-ready recordkeeping. If you want a hassle-free path, select one that brands itself as ISF Solution – ISF Customs Broker for U.S. Customs Bond, Entry Filing, and Import Compliance so they can handle the entire compliance chain.

Compliance practices specific to industrial goods

- Keep technical specifications available for inspection

- Reconcile manufacturer addresses against supplier contracts

- Track logistics changes and ensure timely ISF amendments

- Keep proof of ISF filing and acceptance for your records

Well-maintained records help in case of audit or dispute.

Handling unusual scenarios

- If goods are returned or rejected overseas, document the reason and update ISF records as necessary.

- If a shipment is re-routed or transshipped, confirm whether a new ISF is required and act quickly.

- If customs audits request historical ISF records, provide the original filings and documentation that justified classifications.

Preparing for these ensures you’re not caught off-guard.

Best-in-class operational tips

- Use standardized data templates for suppliers to complete at order confirmation.

- Keep a rolling log of continuous bond coverage and renewal dates.

- Schedule internal compliance reviews quarterly if you import often.

- Train procurement and logistics staff on ISF data needs.

Operational discipline directly improves clearance outcomes.

Final thoughts

By relying on a specialist who manages bonds, ISF, and entries, you can focus on your business rather than paperwork. For complex imports like rubber bale cutters, that expertise prevents delays, mitigates penalties, and ensures a predictable supply chain.

?Are you organizing a shipment of rubber bale cutters and wondering which service can help you handle both ISF and customs clearance?

Why Should I File ISF For Rubber Bale Cutters

ISF is a non-negotiable compliance step that ensures CBP receives advance information about your cargo. Rubber bale cutters are technical items; accurate ISF details make clearance smoother and reduce inspection likelihood.

How ISF supports customs clearance

ISF provides CBP with the data they need to pre-screen cargo. When ISF aligns with your customs entry, CBP can move faster to release your shipment, which helps your domestic logistics run on schedule.

Key steps to take for a successful filing

- Identify the filer (you or a broker).

- Collect manufacturer, supplier, and consignee data.

- Confirm HTS classification or provide a precise product description.

- Ensure ISF filing is completed 24+ hours prior to vessel departure.

- Monitor acceptance and prepare for any required amendments.

These steps form the backbone of your import compliance program.

Working with a combined ISF and customs clearance provider

A single provider that handles ISF and customs clearance reduces error and tightens coordination. They can file ISF, secure U.S. customs bonds, prepare entries, and arrange pickup — streamlining your entire import flow.

Services to expect from a full provider

- ISF filing and amendment handling

- Customs entry filing and duty calculation

- U.S. customs bond procurement and management

- Coordination with carriers and trucking companies

- Recordkeeping and audit support

This integrated approach simplifies your responsibilities and speeds clearance.

What to watch for with rubber bale cutters

- Classification nuances that affect duty rates and admissibility

- Manufacturer and origin complexities if parts are sourced internationally

- Packing and weight documentation to ensure accurate filings

Address these early to avoid customs friction.

Documentation checklist you should maintain

- Commercial invoice with accurate values and description

- Packing list showing units per carton and gross/net weights

- Manufacturer address and country of origin documentation

- Booking confirmation and bill of lading

- Evidence of ISF filing and CBP acceptance

Keeping these organized will speed both ISF and the subsequent entry process.

Handling problems and appeals

If CBP holds the shipment or imposes a penalty, you’ll need to work with your broker to respond. Actions can include submitting additional documentation, arranging inspections, or challenging penalties through formal protest procedures.

How an integrated provider helps in problem scenarios

An integrated ISF and clearance service can expedite responses to CBP requests, coordinate inspections, and manage re-delivery once release is granted. To get this level of support, consider a partner that explicitly offers ISF Solution and Customs Clearance Services — they can take the end-to-end burden off your team.

Final checklist before shipping

- Confirm ISF filing and acceptance

- Confirm customs entry strategy and duties pay plan

- Confirm bond coverage and broker responsibilities

- Schedule trucking only after release confirmation

- Keep copies of all filings and communications

Closing note

Filing ISF for your rubber bale cutters is not just regulatory overhead — it’s a control point that keeps your imports predictable. If you want a smooth path to customs release and domestic delivery, working with a provider that combines ISF and customs clearance makes the whole experience simpler and more reliable.